Ph.D. in economics from Cornell University, USA.

Qualifications

Areas of Expertise

Economics

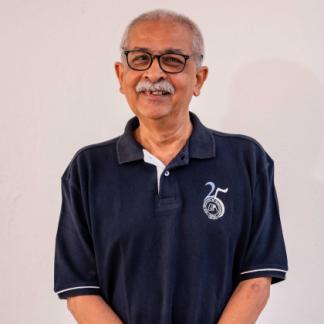

Arindam Das Gupta

Profile & History

Arindam Das-Gupta holds a Ph.D. in economics from Cornell University, USA. He earlier had faculty positions at IIM, Ahmedabad, National Institute of Public Finance and Policy, New Delhi, the Nanyang Business School of the Nanyang Technological University, Singapore, Indira Gandhi Institute of Development Research, Mumbai and the Lee Kuan Yew School of Public Policy of the National University of Singapore. A public policy oriented microeconomist he has published extensively particularly in the area of tax theory and policy. He has served on or assisted several Indian central and state government committees. In 1998 he became, by invitation, the first coordinator of the Tax Policy and Administration Thematic Group at the World Bank, Washington, D.C. There he coordinated the setting up of their knowledge management web site on Tax Policy and Administration*, and was associated with their tax reform operations in 22 countries. Subsequently, he has been a consultant to the Arab Monetary Fund, Asian Development Bank, International Financial Corporation, Planning Commission (Government of India), United Nations Development Program and the World Bank. While at the Lee Kuan Yew School he also helped deliver training programmes for officials of the governments of India, Kazakhstan, Singapore and Vietnam.

Research

Publications:

- Das-Gupta, A. An Assessment of the Revenue Impact of the State Level VAT in India. Economic and Political Weekly, 48(10), 55-64 (2012).

- Das-Gupta, A. Institutions for Performance Oriented Tax Administration. PES Business Review (2009).

- Das-Gupta, A. Internal Trade Barriers in India: Fiscal Check-posts. South Asian Economic Journal, 7(2), 231-254 (2006).

- Das-Gupta, A. With Non-Competitive Firms, a Turnover Tax Can Dominate the VAT. Economics Bulletin, 8(9), 1-6 (2005).

- Das-Gupta, A. Recent Individual Income Tax Reform. Economic and Political Weekly, 40(14), 1397-1405 (2005).

Books:

- Das-Gupta, A., & Mookherjee, D. Incentives and institutional reform in tax enforcement: An analysis of developing country experience (p. 494). New Delhi: Oxford University Press, Paperback. (2000).

- Das-Gupta, A., & Mookherjee, D. Incentives and institutional reform in tax enforcement: An analysis of developing country experience (p. 496). New Delhi: Oxford University Press, Hardcover. (1998).

- Ghate, P., & Others. Informal finance: Some findings from Asia. Oxford: Published for the Asian Development Bank by Oxford University Press. (1992).

Book Chapters:

- Das-Gupta, A. Inclusive Growth: The Key to India's Sustainable Development. In M. Bawa, (Eds.) Forwarded by Patil, R B, Inclusive Growth: The Key to India's Sustainable Development. Regal Publications: New Delhi (2017).

- Das-Gupta, A. Fiscal Resources for Inclusive Growth. In D. Park, S. Lee and M. Lee (Eds.), Inequality, Inclusive Growth, and Fiscal Policy in Asia (pp. 167-201). New York, USA and Oxford, UK: Routledge and Asian Development Bank. (2015).

- Das-Gupta, A., Ghosh, S., & Mookherjee, D. Tax Administration Reform and Tax-Payer Compliance in India. In J. Alm & J. Martinez-Vazquez (Eds.), Tax Reform in Developing Countries (pp. 575-600). Reprinted from International Tax and Pubic finance (2004), 11(5), 575-600. UK: Edward Elgar Publishing. (2015).

- Bird, R., & Das-Gupta, A. Public Finance in Developing Countries. In B. Currie-Alder, R. Kanbur, D. Malone, & R. Medhora (Eds.), International Development: Ideas, Experience, and Prospects. New York: Oxford University Press. (2014).

- Das-Gupta, A., & Bird, R. Public Finance in Developing Countries. In D. Malone, R. Kanbur, R. Medhora, & B. Currie-Alder (Eds.), A Handbook on Development Thought. New York: Oxford University Press (2013).

- Das-Gupta, A. Economic Analysis of India's Double Tax Avoidance Agreements. In U. Sankar & D. Srivastava (Eds.), Development and Public Finance: Essays in Honor of Raja J Chelliah. New Delhi: Sage Publications (2012).

- Das-Gupta, A. Corruption. In K. Basu & A. Maertens (Eds.), the New Oxford Companion to Economics in India. New Delhi: Oxford University Press (2011).

- Das-Gupta, A. Neglected Topics in Public Economics Courses. In M.G. Rao & S. Acharya (Eds.), Public Economics: Theory and Policy (Essays in memory of the late Professor Amaresh Bagchi). New Delhi: Sage Publications (2010).

Others:

- Das-Gupta, A. Fiscal Resources for Inclusive Growth, (background Paper for Asian Development Outlook). ADB Economic Working Paper Series Number 416, Manila: Asian Development Bank (2014).

- Das-Gupta, A. How DTC Perpetuates Corruption. Business Standard. Retrieved from http://www.business-standard.com/article/opinion/arindam-das-gupta-how-dtc-perpetuates-corruption-112012100004_1.html (2012, January 21).

- Das-Gupta, A. Fiscal reform: Why not tackle the waste? Business Standard. Retrieved from https://www.business-standard.com/article/opinion/arindam-das-gupta-fiscal-reform-why-not-tackle-the-waste-111042500037_1.html (2011, April 25).

- Das-Gupta, A. The case for an income tax amnesty. Business Standard. Retrieved from https://www.business-standard.com/article/opinion/arindam-das-gupta-the-case-for-income-tax-amnesty-111022800041_1.html (2011, February 28).

- Das-Gupta, A. Public Expenditure Management Committee Report: A Critical Review. Economic and Political Weekly, 46(43), 15-19 (2011).

- Das-Gupta, A. The Thirteenth Finance Commission and improving fiscal outcomes: An assessment. Economic and Political Weekly, 45(48),78-83 (2010).